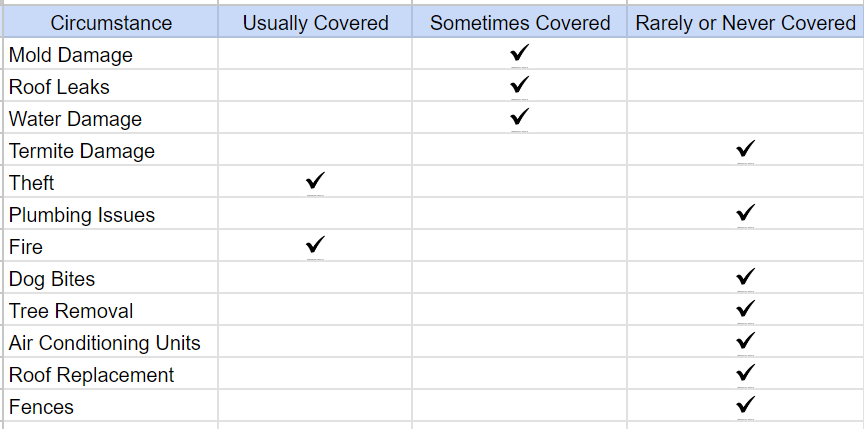

In this guide, we’ll explain the nitty-gritty of what is and what’s not covered by a homeowners insurance policy. We’ll cover the specifics and questions that may be of particular concern to you. For example, you may wonder if a typical homeowners insurance policy covers damage from mold, termites, and roof leaks, or whether you’re covered if your dog bites a visitor. We’ll also highlight things that are not typically covered. Finally, we’ll explain the difference between a cash value policy and a replacement cost policy, what to expect when you make a claim, and how long you should expect to wait before receiving payment from your homeowner’s insurance company.

Standard Homeowners Insurance Coverage

A standard homeowners insurance policy provides coverage to repair or replace your home and its contents in the event of damage. That usually includes damage resulting from fire, smoke, theft, or vandalism, or damage caused by a weather event such as lightning, wind, or hail. Other covered damage could come from external forces like a falling tree.

That coverage includes your heating and cooling systems, along with kitchen appliances, furniture, clothing, and other possessions. Coverage for outbuildings on your property, such as a garage, barn, or shed, along with outdoor grills or fireplaces, swing sets, walls, or fences is also included. A swimming pool or other recreational equipment may also be covered, but those higher-risk items may require additional liability coverage.

In addition, you’re typically covered for living expenses if you need to find alternate lodging while your home is rebuilt. Liability coverage is typically included as well. That means you’ll be reimbursed for medical expenses and legal fees if people that are not living in your home are injured on your property.

It’s important to understand the details of your policy, and how much coverage you can expect in the event of a claim. Some lenders only require sufficient homeowners insurance coverage to pay off your mortgage, but in most cases that will not be nearly enough to rebuild your home and replace everything in it.

It’s also important to consider that rebuilding costs may increase. Improvements or additions to made to your home, increased labor or material costs, and changes to zoning requirements might require more coverage.

For all these reasons, you may want to consider a replacement-cost homeowners insurance policy rather than an actual cash-value policy. The former provides coverage to make repairs or replace your home and its contents at current costs. A cash value policy factors in depreciation due to age, wear and tear, and other factors.

As an example, let’s say a falling tree damages your roof, which was last replaced 10 years ago. A replacement cost policy will pay to replace the roof at today’s cost for labor and materials. An actual cash value policy will deduct 10 years of depreciation. The same logic applies to your furnace, washing machine, and other possessions. Replacement cost is more expensive, but industry experts say it is worth the added cost.

“Know the difference between an actual cash value policy and a replacement cost policy,” says Lynne McChristian of the Insurance Information Institute (III), “The former pays the depreciated cost, so you get less at claim time. With replacement cost, you may pay 10 to 15% more for coverage, yet you get much more when you file a claim.”

To estimate how much homeowners insurance coverage you need, multiply the square footage of the home by the local building costs per square foot in your area. For example, if your home is 2,200 square feet and local building costs average $80 per square foot, the cost to rebuild your home would be about $176,000. A local insurance agent should be able to help determine costs in your area. You’ll calculate costs the same way for any outbuildings.

Next, take an inventory of all your possessions with an estimated value. Take photos or videos to provide a visual record. Make a note of where and when you purchased things on your inventory, especially big-ticket items. This will not only provide a record, it will also help determine how much coverage you need, and what items might require additional coverage.

According to the III, most homeowners insurance policies typically cover your belongings at a rate of about 50% to 70% of what your home is insured for. Meaning that if your home is insured for $400,000, you can expect to be reimbursed for somewhere around $200,000 to $280,000 for your furniture, clothing, and other possessions. If your inventory determines that isn’t sufficient for your needs, consider additional coverage.

Does Homeowners Insurance Cover Mold Damage?

Mold is generally not covered by homeowners insurance. Some companies cover mold damage with limitations, for example, if it’s caused by a covered event like a burst pipe. If mold damage is deemed to be the result of a lack of maintenance, it is generally not covered.

Standard Homeowners Insurance Coverage

A standard homeowners insurance policy provides coverage to repair or replace your home and its contents in the event of damage. That usually includes damage resulting from fire, smoke, theft or vandalism, or damage caused by a weather event such as lightning, wind, or hail. Other covered damage could come from external forces like a falling tree.

That coverage includes your heating and cooling systems, along with kitchen appliances, furniture, clothing, and other possessions. Coverage for outbuildings on your property, such as a garage, barn, or shed, along with outdoor grills or fireplaces, swing sets, walls, or fences is also included. A swimming pool or other recreational equipment may also be covered, but those higher-risk items may require additional liability coverage.

In addition, you’re typically covered for living expenses if you need to find alternate lodging while your home is rebuilt. Liability coverage is typically included as well. That means you’ll be reimbursed for medical expenses and legal fees if people that are not living in your home are injured on your property.

It’s important to understand the details of your policy, and how much coverage you can expect in the event of a claim. Some lenders only require sufficient homeowners insurance coverage to pay off your mortgage, but in most cases that will not be nearly enough to rebuild your home and replace everything in it.

It’s also important to consider that rebuilding costs may increase. Improvements or additions to made to your home, increased labor or material costs, and changes to zoning requirements might require more coverage.

For all these reasons, you may want to consider a replacement-cost homeowners insurance policy rather than an actual cash-value policy. The former provides coverage to make repairs or replace your home and its contents at current costs. A cash value policy factors in depreciation due to age, wear and tear, and other factors.

As an example, let’s say a falling tree damages your roof, which was last replaced 10 years ago. A replacement cost policy will pay to replace the roof at today’s cost for labor and materials. An actual cash value policy will deduct 10 years of depreciation. The same logic applies to your furnace, washing machine, and other possessions. Replacement cost is more expensive, but industry experts say it is worth the added cost.

“Know the difference between an actual cash value policy and a replacement cost policy,” says Lynne McChristian of the Insurance Information Institute (III), “The former pays the depreciated cost, so you get less at claim time. With replacement cost, you may pay 10 to 15% more for coverage, yet you get much more when you file a claim.”

To estimate how much homeowners insurance coverage you need, multiply the square footage of the home by the local building costs per square foot in your area. For example, if your home is 2,200 square feet and local building costs average $80 per square foot, the cost to rebuild your home would be about $176,000. A local insurance agent should be able to help determine costs in your area. You’ll calculate costs the same way for any outbuildings.

Next, take an inventory of all your possessions with an estimated value. Take photos or videos to provide a visual record. Make a note of where and when you purchased things on your inventory, especially big-ticket items. This will not only provide a record, it will also help determine how much coverage you need, and what items might require additional coverage.

According to the III, most homeowners insurance policies typically cover your belongings at a rate of about 50% to 70% of what your home is insured for. Meaning that if your home is insured for $400,000, you can expect to be reimbursed for somewhere around $200,000 to $280,000 for your furniture, clothing, and other possessions. If your inventory determines that isn’t sufficient for your needs, consider additional coverage.

Does Homeowners Insurance Cover Mold Damage?

Mold is generally not covered by homeowners insurance. Some companies cover mold damage with limitations, for example, if it’s caused by a covered event like a burst pipe. If mold damage is deemed to be the result of a lack of maintenance, it is generally not covered.

Does Homeowners Insurance Cover Roof Leaks?

Standard homeowners insurance policies usually cover roof leaks that are caused by a covered event, such as a storm or hail. In that case, the policy also will pay for repairs. If the cause of the leak is determined to be a lack of maintenance, the cost to repair the damage may not be covered.

Does Homeowners Insurance Cover Water Damage?

Water damage from something like a burst pipe or failed washing machine hose is generally covered by a standard homeowners insurance policy, with the caveat that damage caused by a lack of maintenance is typically not covered. Flood insurance is not included in a standard policy, nor is a backup from a clogged drain or a failed sump pump. These coverages may be available at extra cost.

Does Homeowners Insurance Cover Termite Damage?

Damage caused by termites is generally considered preventable and thus caused by the homeowner’s lack of attention and proper maintenance. In some circumstances such as a fire caused by a termite chewing through wiring, some insurers may provide coverage.

Does Homeowners Insurance Cover Theft?

Most standard homeowners insurance policies include coverage for losses from theft and vandalism, but all policies cap the amount the insurance company will pay. Valuable items such as jewelry, artwork, or collectibles may exceed the limits of a standard policy and require additional coverage.

Does Homeowners Insurance Cover Plumbing Issues?

A burst pipe or failed water heater is typically covered by a standard homeowners insurance policy, as long as the damage is not caused by improper or insufficient maintenance. Damage caused by a slow leak over time, for example, may not be covered.

Does Homeowners Insurance Cover Fires?

All standard homeowners insurance policies include coverage for damage from fire and smoke. Such coverage generally includes teardown, clean-up, and rebuilding costs for the main structure and outbuildings, along with replacing furniture and possessions in the home. Most policies also include loss of use coverage to pay for alternate lodging while your home is rebuilt.

Does Homeowners Insurance Cover Dog Bites?

If you have a dog that bites someone visiting your property, you may have some coverage under the liability portion of your homeowner’s insurance policy. Depending on your level of concern, the dog’s disposition, and your risk tolerance, you may want to consider additional liability coverage. Some insurance companies will not insure certain dog breeds.

Does Homeowners Insurance Cover Tree Removal?

If a tree falls on your house, garage, or other structure covered by your homeowner’s insurance policy during a storm, most insurance companies will pay to have it removed up to the limits of your policy. If the tree falls on the ground without causing other damage, the cost of removal is generally not covered. If the damage is caused by an unhealthy tree, it may not be covered if it is deemed a lack of maintenance.

Does Homeowners Insurance Cover Air Conditioning Units?

A home air conditioning unit or system is covered for theft, fire, storm damage, or any other reason included in a standard homeowners insurance policy, subject to the limits of that policy. Damage from wear and tear, negligence, or misuse is not covered.

Does Homeowners Insurance Cover Foundation Repairs?

Damage to the foundation of your home is covered if it is caused by a storm, fire, or other event that is included in a homeowners insurance policy. Flood and earthquake damage require separate policies. Damage caused by neglect, lack of maintenance, or faulty construction is not covered.

Does Homeowners Insurance Cover Roof Replacement?

Homeowners Insurance can help pay to repair or replace your roof if the damage is a result of fire, storm damage, or any other reason that is included in the policy. Things like wear and tear, age, neglect, or abuse are not covered.

Does Homeowners Insurance Cover Fences?

Fences and walls are generally considered to be a structure and thus are covered much like a garage or other outbuilding. Most standard homeowners policies include repairs or replacement due to storm damage, fire, wind, or other causes included in your policy. Things like age, neglect, or wear and tear are not typically covered. Shrubs and plantings are similarly covered.

What Standard Homeowner Insurance Policies Don’t Cover

Most of these coverages are generally available at an extra cost, or simply by purchasing sufficient additional coverage beyond the limits of a standard policy to cover expensive jewelry and valuables. Many standard homeowners insurance policies have a limit of $1,000 to $2,000 for jewelry, but offer additional policies to cover pricier items.

Flooding is another hazard that is typically not covered by standard homeowners insurance policies. However, flood insurance may be a requirement depending on where you live. If that’s the case for you, most major insurance companies offer optional flood insurance. If you live in a particularly high-risk area and can’t get flood insurance, you may be able to get a policy directly from the National Flood Insurance Program, administered by FEMA. Even if you get your flood insurance through your home insurance carrier, it’s backed by the NFIP. Costs and requirements can vary depending on risk factors in your area but are set by the NFIP, not by the insurance company.

The Federal Emergency Management Agency website has an interactive map that can help determine flood risk in your area, simply by entering your address or ZIP code. One last thing to keep in mind: with a few exceptions there is a 30-day waiting period before flood insurance goes into effect. It’s best to shop well before you think you might need it.

Like flood insurance, earthquake coverage is offered by many insurers either as an option or as a separate policy. Unlike flood insurance, rates are set by the insurer, not the federal government. That means that the cost of your policy will depend upon your insurer, your location, the type of home you own, and many other factors.

To determine the types of coverage you should buy, start with the most obvious factors. If you live in or are looking at homes in an area prone to floods, earthquakes, wildfires, or other extreme weather, look for a policy that provides coverage for those types of events. Keep in mind these types of coverage aren’t usually included in a standard policy, and some insurers may not provide coverage at all.

Next, determine what it would cost to replace major items such as your furnace, water heater, roof, or your entire home. Talk to an independent insurance agent, call insurance companies directly, or check company websites for guidelines. Take an inventory of your possessions, including your vehicles, artwork, and other valuables. Consider what it might cost to live with relatives, in a hotel, or in a rental unit while your home is being repaired or rebuilt.

A basic rule of thumb is to make sure you buy enough coverage to replace your home and its contents. Be honest in your assessments and make sure that any policy you consider will be sufficient.

Homeowners Insurance Replacement Cost

Most insurance companies will offer you a choice of two types of homeowners insurance policies – a cash value policy or a replacement cost policy. For most people, a replacement cost policy is the better option.

The reason is that replacement cost coverage policies pay for the actual cost to repair or replace your home and possessions at current prices – or at least come close depending on the limits of your policy. A cash value policy caps the amount you’ll be reimbursed for your home and its contents, less depreciation.

For this reason, a replacement cost policy is usually a better bet if your budget allows it. Replacement cost policies generally cost more than a comparable cash value policy, but the difference could be made up quickly if you have to make a claim.

“Depreciation is a big deal,” said Amy Bach of the consumer advocacy group United Policyholders.

“It’s much better to have replacement coverage because that’s what you need to rebuild your home. You need to balance price and value.”

Many things can increase rebuilding costs over time. Some factors include labor and material costs, housing demand, changes to zoning requirements and building codes, and inflation. A replacement cost policy helps provide a cushion against these increases, especially the longer you remain in your home. The $250,000 in coverage you buy today may not come close to the cost of rebuilding in 10 years.

The same logic applies to furniture, appliances, clothing, and other possessions. Inflation ensures that most things cost more over time. A replacement cost policy helps ensure that your homeowner’s insurance will keep up with those increases.

When Does Homeowners Insurance Pay Out?

Depending on the complexity of your claim and the amount of damage, it can take anywhere from a few weeks to a few years before a claim is settled and you are paid.

Assuming you promptly file a claim with whatever documentation is required by your insurer and you’re satisfied with the settlement, you might see reimbursement for something like wind damage to your roof within weeks. A complicated claim can take longer.

“In the event of a catastrophe, most insurers pay within a few weeks to six months,” said Janet Ruiz of the III. Rebuilding a home after a total loss, however, can take 18 to 24 months, according to consumer advocacy group United Policyholders.

Any dispute between you and the insurer will lengthen the claim, whether that’s caused by the insurer denying the claim or you feel their initial offer is insufficient. If more than one insurer is involved, that could also lengthen the process. A hurricane might cause both wind and water damage, which are often insured by different companies. Most standard homeowners insurance policies provide coverage for wind damage but don’t include flood insurance, which can be purchased as an add-on from most major insurance companies. It can be difficult to tell what damage was caused by wind or water following a storm, and that can lead to a dispute between insurers, which can therefore cause delays in payment.

You can’t do much to avoid certain types of delays, but there are things you can do to make sure the process goes as smoothly as possible. Make sure you ask your agent or insurer questions about anything you don’t understand as you file your claim and make sure you understand and provide everything that is required.

Include thorough documentation to back up your claim, including photos or videos of the damage, along with an inventory and estimated value of lost items. Include copies of any police and fire reports, the names of people you have spoken with, and relevant notes from conversations. Make sure you file the claim within the time required by your insurer and your state and keep copies of everything for your records.

Standard homeowners insurance policies usually cover roof leaks that are caused by a covered event, such as a storm or hail. In that case, the policy also will pay for repairs. If the cause of the leak is determined to be a lack of maintenance, the cost to repair the damage may not be covered.

Does Homeowners Insurance Cover Water Damage?

Water damage from something like a burst pipe or failed washing machine hose is generally covered by a standard homeowners insurance policy, with the caveat that damage caused by a lack of maintenance is typically not covered. Flood insurance is not included in a standard policy, nor is a backup from a clogged drain or a failed sump pump. These coverages may be available at extra cost.

Does Homeowners Insurance Cover Termite Damage?

Damage caused by termites is generally considered preventable and thus caused by the homeowner’s lack of attention and proper maintenance. In some circumstances such as a fire caused by a termite chewing through wiring, some insurers may provide coverage.

Does Homeowners Insurance Cover Theft?

Most standard homeowners insurance policies include coverage for losses from theft and vandalism, but all policies cap the amount the insurance company will pay. Valuable items such as jewelry, artwork, or collectibles may exceed the limits of a standard policy and require additional coverage.

Does Homeowners Insurance Cover Plumbing Issues?

A burst pipe or failed water heater is typically covered by a standard homeowners insurance policy, as long as the damage is not caused by improper or insufficient maintenance. Damage caused by a slow leak over time, for example, may not be covered.

Does Homeowners Insurance Cover Fires?

All standard homeowners insurance policies include coverage for damage from fire and smoke. Such coverage generally includes teardown, clean-up, and rebuilding costs for the main structure and outbuildings, along with replacing furniture and possessions in the home. Most policies also include loss of use coverage to pay for alternate lodging while your home is rebuilt.

Does Homeowners Insurance Cover Dog Bites?

If you have a dog that bites someone visiting your property, you may have some coverage under the liability portion of your homeowner’s insurance policy. Depending on your level of concern, the dog’s disposition, and your risk tolerance, you may want to consider additional liability coverage. Some insurance companies will not insure certain dog breeds.

Does Homeowners Insurance Cover Tree Removal?

If a tree falls on your house, garage, or other structure covered by your homeowner’s insurance policy during a storm, most insurance companies will pay to have it removed up to the limits of your policy. If the tree falls on the ground without causing other damage, the cost of removal is generally not covered. If the damage is caused by an unhealthy tree, it may not be covered if it is deemed a lack of maintenance.

Does Homeowners Insurance Cover Air Conditioning Units?

A home air conditioning unit or system is covered for theft, fire, storm damage, or any other reason included in a standard homeowners insurance policy, subject to the limits of that policy. Damage from wear and tear, negligence, or misuse is not covered.

Does Homeowners Insurance Cover Foundation Repairs?

Damage to the foundation of your home is covered if it is caused by a storm, fire, or another event that is included in a homeowners insurance policy. Flood and earthquake damage require separate policies. Damage caused by neglect, lack of maintenance, or faulty construction is not covered.

Does Homeowners Insurance Cover Roof Replacement?

Homeowners Insurance can help pay to repair or replace your roof if the damage is a result of fire, storm damage, or any other reason that is included in the policy. Things like wear and tear, age, neglect, or abuse are not covered.

Does Homeowners Insurance Cover Fences?

Fences and walls are generally considered to be a structure and thus are covered much like a garage or other outbuilding. Most standard homeowners policies include repairs or replacement due to storm damage, fire, wind, or other causes included in your policy. Things like age, neglect, or wear and tear are not typically covered. Shrubs and plantings are similarly covered.

What Standard Homeowner Insurance Policies Don’t Cover

Standard homeowners insurance policies typically do not include coverage for valuable jewelry, artwork, other collectibles, identity theft protection, or damage caused by an earthquake or a flood.

Most of these coverages are generally available at an extra cost, or simply by purchasing sufficient additional coverage beyond the limits of a standard policy to cover expensive jewelry and valuables. Many standard homeowners insurance policies have a limit of $1,000 to $2,000 for jewelry but offer additional policies to cover pricier items.

Flooding is another hazard that is typically not covered by standard homeowners insurance policies. However, flood insurance may be a requirement depending on where you live. If that’s the case for you, most major insurance companies offer optional flood insurance. If you live in a particularly high-risk area and can’t get flood insurance, you may be able to get a policy directly from the National Flood Insurance Program, administered by FEMA. Even if you get your flood insurance through your home insurance carrier, it’s backed by the NFIP. Costs and requirements can vary depending on risk factors in your area but are set by the NFIP, not by the insurance company.

The Federal Emergency Management Agency website has an interactive map that can help determine flood risk in your area, simply by entering your address or ZIP code. One last thing to keep in mind: with a few exceptions there is a 30-day waiting period before flood insurance goes into effect. It’s best to shop well before you think you might need it.

Like flood insurance, earthquake coverage is offered by many insurers either as an option or as a separate policy. Unlike flood insurance, rates are set by the insurer, not the federal government. That means that the cost of your policy will depend upon your insurer, your location, the type of home you own, and many other factors.

To determine the types of coverage you should buy, start with the most obvious factors. If you live in or are looking at homes in an area prone to floods, earthquakes, wildfires, or other extreme weather, look for a policy that provides coverage for those types of events. Keep in mind these types of coverage aren’t usually included in a standard policy, and some insurers may not provide coverage at all.

Next, determine what it would cost to replace major items such as your furnace, water heater, roof, or your entire home. Talk to an independent insurance agent, call insurance companies directly, or check company websites for guidelines. Take an inventory of your possessions, including your vehicles, artwork, and other valuables. Consider what it might cost to live with relatives, in a hotel or in a rental unit while your home is being repaired or rebuilt.

A basic rule of thumb is to make sure you buy enough coverage to replace your home and its contents. Be honest in your assessments and make sure that any policy you consider will be sufficient.

Homeowners Insurance Replacement Cost

Most insurance companies will offer you a choice of two types of homeowners insurance policies – a cash value policy or a replacement cost policy. For most people, a replacement cost policy is the better option.

The reason is that replacement cost coverage policies pay for the actual cost to repair or replace your home and possessions at current prices – or at least come close depending on the limits of your policy. A cash value policy caps the amount you’ll be reimbursed for your home and its contents, less depreciation.

For this reason, a replacement cost policy is usually a better bet if your budget allows it. Replacement cost policies generally cost more than a comparable cash value policy, but the difference could be made up quickly if you have to make a claim.

“Depreciation is a big deal,” said Amy Bach of the consumer advocacy group United Policyholders.

“It’s much better to have replacement coverage because that’s what you need to rebuild your home. You need to balance price and value.”

Many things can increase rebuilding costs over time. Some factors include labor and material costs, housing demand, changes to zoning requirements and building codes, and inflation. A replacement cost policy helps provide a cushion against these increases, especially the longer you remain in your home. The $250,000 in coverage you buy today may not come close to the cost of rebuilding in 10 years.

The same logic applies to furniture, appliances, clothing, and other possessions. Inflation ensures that most things cost more over time. A replacement cost policy helps ensure that your homeowner’s insurance will keep up with those increases.

When Does Homeowners Insurance Pay Out?

Depending on the complexity of your claim and the amount of damage, it can take anywhere from a few weeks to a few years before a claim is settled and you are paid.

Assuming you promptly file a claim with whatever documentation is required by your insurer and you’re satisfied with the settlement, you might see reimbursement for something like wind damage to your roof within weeks. A complicated claim can take longer.

“In the event of a catastrophe, most insurers pay within a few weeks to six months,” said Janet Ruiz of the III. Rebuilding a home after a total loss, however, can take 18 to 24 months, according to the consumer advocacy group United Policyholders.

Any dispute between you and the insurer will lengthen the claim, whether that’s caused by the insurer denying the claim or you feel their initial offer is insufficient. If more than one insurer is involved, that could also lengthen the process. A hurricane might cause both wind and water damage, which are often insured by different companies. Most standard homeowners insurance policies provide coverage for wind damage but don’t include flood insurance, which can be purchased as an add-on from most major insurance companies. It can be difficult to tell what damage was caused by wind or water following a storm, and that can lead to a dispute between insurers, which can therefore cause delays in payment.

You can’t do much to avoid certain types of delays, but there are things you can do to make sure the process goes as smoothly as possible. Make sure you ask your agent or insurer questions about anything you don’t understand as you file your claim and make sure you understand and provide everything that is required.

Include thorough documentation to back up your claim, including photos or videos of the damage, along with an inventory and estimated value of lost items. Include copies of any police and fire reports, the names of people you have spoken with, and relevant notes from conversations. Make sure you file the claim within the time required by your insurer and your state and keep copies of everything for your records.

Source: usnews.com ~ By Jim Travers ~ Image: usnews.com