Mortgage rate forecast for next week (September 5-11, 2021)

Low mortgage rates look like they’re here to stay for the time being.

The August jobs report, which came out Friday, was far weaker than anticipated. This goes to show the Delta variant is taking a bigger toll on the economy than some expected.

That means mortgage rates should continue in the sub-3% range for at least a while longer

Will mortgage rates go down in September?

It seems like mortgage rates will stay in their current low range throughout September, at least until the end of the month.

Concerns around the Delta variant are still keeping rates low. And recent reports show our economic recovery slowing down.

The August jobs report — released September 3 — showed only 235,000 new jobs created in August. That was far below the forecast of 750,000 new jobs.

“The rising number of Covid-19 cases tied to the Delta variant could result in slower job growth for two reasons,” reported Wall Street Journal.

“Businesses, particularly in services sectors requiring in-person contact, could hold off on hiring amid heightened pandemic uncertainty. Jobless individuals who are fearful of Covid-19 health risks might also be slower to return to the labor market until the virus abates.”

Remember that the weaker the economy is, the longer interest rates will stay low.

Experts aren’t expecting mortgage rates to rise substantially until the Fed makes a firm announcement about when it will start tapering its bond-buying program. And, as Fed Chair Powell has said, they won’t make that announcement until they see further progress toward maximum employment. This report throws a wrench in that progress.

Will we learn more about tapering plans when the FOMC meets at the end of September? And will mortgage interest rates rise as a result?

That’s yet to be seen — but it seems less likely now than it did a week ago.

For now, low mortgage rates are sticking around. And home buyers and homeowners can still save big on their housing costs.

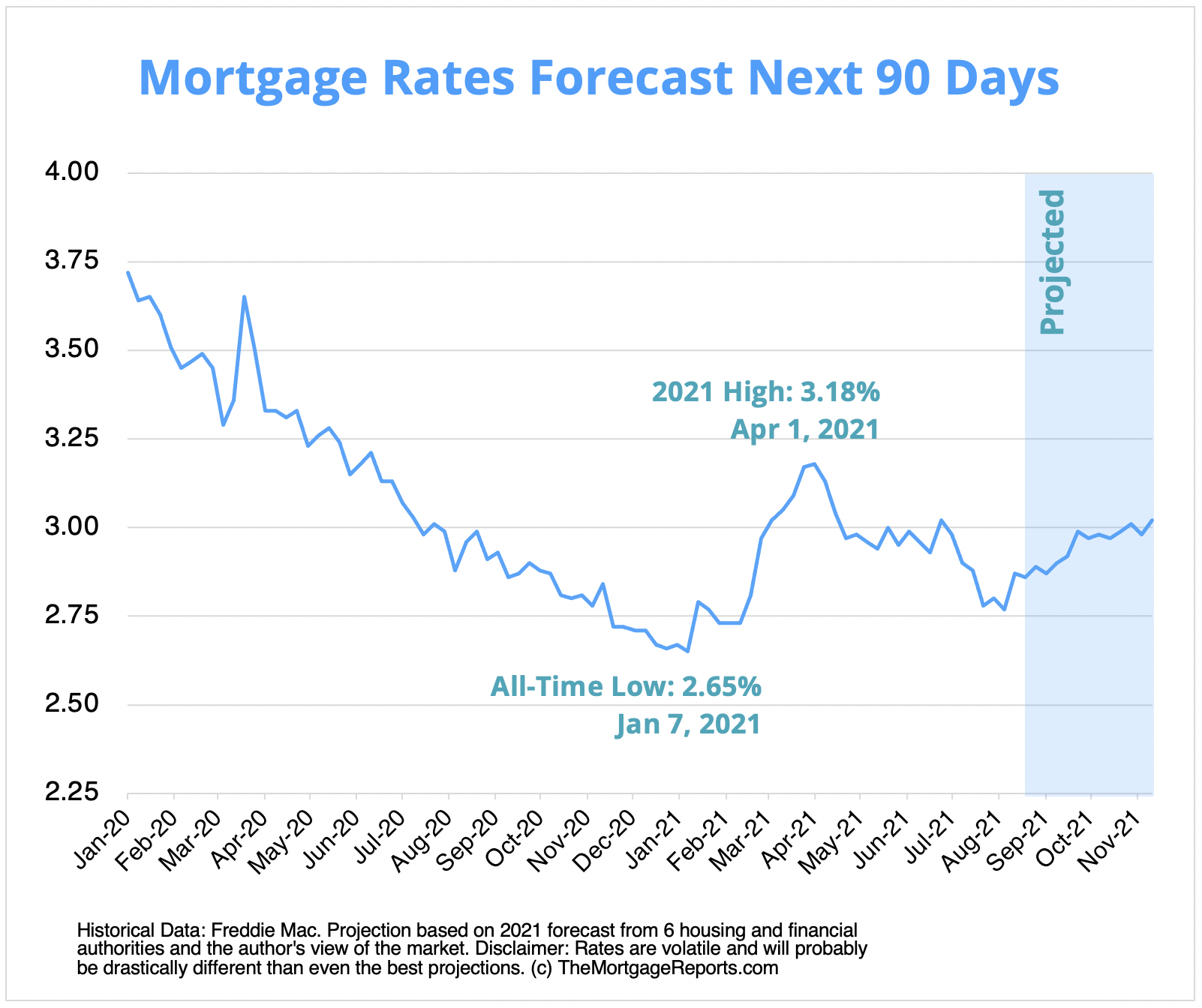

Mortgage interest rates forecast next 90 days

We expect mortgage rates to continue to hover near or just below 3% for the next few weeks. Over the next 90 days, a modest overall increase seems likely.

Based on expert mortgage rate predictions and forecasts from housing authorities, 30-year mortgage rates could go as high as 3.17% within the next 90 days.

Mortgage rate predictions for late 2021

Experts are split on their mortgage rate predictions for fall and winter of 2021.

Fannie Mae and the National Association of Home Builders see average 30-year rates staying below 3% through Q4 2021, while agencies like Freddie Mac and the Mortgage Bankers Association predict 30-year rates as high as 3.3 to 3.4% by the end of the year.

In any case, mortgage interest rates should stay in the low- to mid-3% range throughout the second half of 2021. No one is expecting a dramatic spike any time soon.

| Housing Authority | 30-Yr Mortgage Rate Prediction (Q4 2021) |

| Fannie Mae | 2.90% |

| National Assoc. of Home Builders | 2.94% |

| National Association of Realtors | 3.20% |

| Wells Fargo | 3.25% |

| Mortgage Bankers Association | 3.30% |

| Freddie Mac | 3.40% |

| Average Prediction | 3.17% |

What could cause mortgage rates to rise or fall?

Many industry experts believed rates would rise further and faster in 2021.

However, there’s a tug-of-war in the current market keeping mortgage rates low even when it seems like they should have risen.

What could drive mortgage rates up?

- An improving economy — The better the U.S. economy performs for jobs, consumer spending, and overall growth, the higher interest rates should go

- Inflation — Inflation almost always leads to higher mortgage rates, and inflation rates in 2021 have far exceeded expectations. (Although the Federal Reserve still maintains current inflation rates should be temporary)

- Real estate demand — Despite low inventory, demand for new homes and existing homes remains incredibly strong. Normally, a surge in mortgage financing should lead to higher rates

What’s keeping mortgage rates low?

- The Delta variant — Fear that the coronavirus Delta variant could stall economic growth at home and abroad is pushing mortgage rates down. Remember that weaker economies lead to lower mortgage rates

- Easy money policies by the Federal Reserve — By keeping its benchmark interest rate (the Federal Funds Rate) near 0% and continuing to purchase billions of dollars worth of mortgage-backed securities (MBS), the Fed is keeping mortgage rates artificially low

- Foreign investment in U.S. debt — Foreign investors continue to purchase relatively safe U.S. investments, including things like 10-Year Treasury bonds and MBS. An influx of dollars from these investors means continued low interest rates for borrowers

The Federal Reserve and mortgage rates

Currently, the Federal Reserve is purchasing $40 billion per month in mortgage-backed securities (MBS) as part of its Covid stimulus program.

This is one of the single biggest factors keeping mortgage rates as low as they are.

When the Fed slows or ‘tapers’ its purchasing of MBS, mortgage rates are almost certain to increase by a wider margin than we’ve seen this year.

And that could be coming in the not-too-distant future.

In a speech on August 27, Fed Chair Jerome Powell indicated that asset purchase tapering could begin before the end of the year — depending on how the Delta variant plays out economically.

Asset purchase tapering could begin before the end of the year — depending on how the Delta variant plays out economically.

“We have said that we would continue our asset purchases at the current pace until we see substantial further progress toward our maximum employment and price stability goals,” said Powell. “My view is that the ‘substantial further progress’ test has been met for inflation. There has also been clear progress toward maximum employment.”

He continued on to say that in light of these positive trends, he and other Fed members believe it may be “appropriate to start reducing the pace of asset purchases this year.”

But — and it’s a big ‘but’ — the Fed still isn’t clear on what the overall economic impact of the Delta variant will look like. And because of that, it’s not ready to make any firm plans to start withdrawing support in 2021.

Now, all eyes are on the FOMC meeting on September 21-22.

By then we should know at least a little more about how the pandemic is impacting U.S. economic progress. And we may hear further news on tapering.

Until then, rates should stay in or near their current low range.

Source: themortagereports.com ~ By: Tim Lucas ~ Image: themortagereports.com