— And They’re Great for Home Buyers

Mortgage rates ticked up slightly over the past week but remain near all-time lows as demand for home purchases continue to show improvement amid the easing of the COVID-19 lockdown.

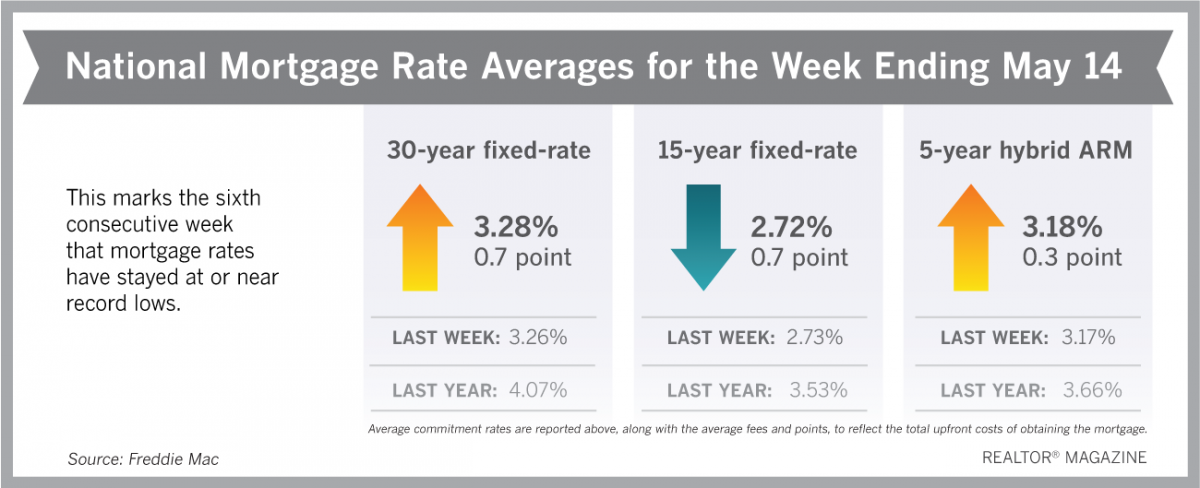

According to Freddie Mac, the interest rate for a 30-year fixed-rate mortgage averaged 3.28% with .07 points paid for the week ending May 14, up 0.02 percentage points from the previous week and 0.05 percentage points above the record low of 3.23% set on April 30.

The average interest rate for a 15-year fixed-rate mortgage held almost steady, coming in at 2.72% with .07 points paid, down just 0.01 percentage points from last week’s 2.73%. Interest rates on five-year adjustable-rate mortgages were up 0.01 percentage points to 3.18% with 0.03 points paid.

While mortgage rates have remained mostly steady since the start of April, that may change in the next few weeks as Federal Reserve Chairman Jerome Powell warned that the U.S. economy was in for a long and slow recovery with a high degree of uncertainty. The comments sent 10-year Treasury yields down to 0.612% as of Thursday morning, from 0.651% at closing on Wednesday. Mortgage rates are pegged to 10-year Treasury notes.

Home purchase loan applications continued their upward trend, as mortgage rates have stayed near record lows. According to the Mortgage Bankers Association Weekly Mortgage Applications Survey for the week ending May 8, the home Purchase Index increased 11% from one week ago, with five of the 10 largest states included in the survey registering double-digit gains.

New York led the way with a 14% increase in purchase loan applications, followed by California with an 11% increase. Other states with significantly increased home purchasing activity include Illinois, Georgia, Florida, and North Carolina. As the nationwide lockdown is slowly eased, home purchase activity is expected to keep increasing.

Refinance activity continued to fall for the fourth week in a row, as the MBA’s Refinance Index decreased by 3%. Despite this decrease refinance activity remains the major focus of lender activity, representing 67% of total mortgage applications, down from 70% from a week ago.