The zero-down payment mortgage

A no-down-payment mortgage lets first-time home buyers buy a house with no money, except standard closing costs.

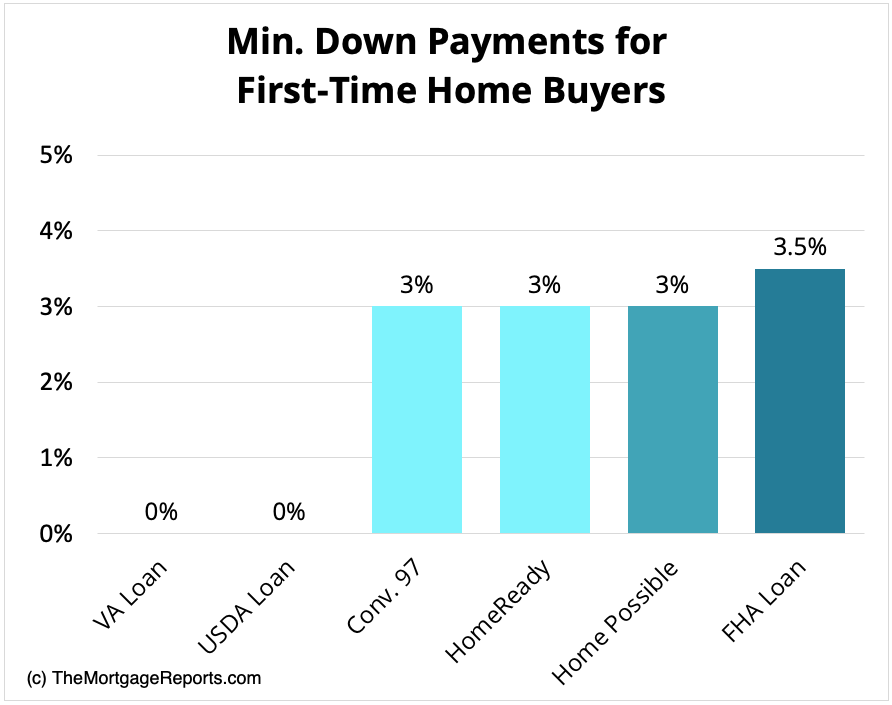

Other options, like the FHA loan and Conventional 97, allow as little as 3% down. And home buyers nationwide can apply for government grants and loans to cover their out-of-pocket costs.

That makes it possible to get into a home with no money — or very little money — down.

How to buy a house with no money down

The easiest way to buy a house with no money down is to use a government-backed mortgage. The VA loan and USDA loan programs, for example, both allow $0 down.

Not everyone will qualify for these programs. USDA loans have geographical and income requirements; VA loans work only for military buyers. But that’s OK. You still have other options to explore.

- Apply for a zero-down VA loan or USDA loan

- Use government assistance to cover the down payment

- Ask for a down payment gift from a family member

- Get the lender to pay your closing costs (“lender credits”)

- Get the seller to pay your closing costs (“seller concessions”)

When combined, these tactics could put you in a new home with minimal cash out of pocket.

Can I buy a house with no money down?

Realistically, most first-time home buyers will need to pay at least a 3% to 3.5% down payment. That’s the minimum for a conventional or FHA loan, which are the most common mortgage types.

While zero-down home loans exist, they’re intended for select groups like veterans and rural home buyers who earn a moderate or low income. The majority of buyers are more likely to qualify for a low-down-payment mortgage rather than a zero-down loan.

The good news is, every state offers some type of home buyer assistance. These government grant programs may cover your down payment so you don’t have to pay out of pocket.

Keep in mind that, as a buyer, you have to pay closing costs, too — and those might cost more than your down payment. But there are several ways you can get all or at least part of your fees covered and avoid paying up front. Talk to your loan officer about options to reduce your out-of-pocket fees.

Zero-down first-time home buyer loans

The USDA loan program and the VA loan program allow eligible buyers to buy a house with no money. Both are available to first-time home buyers and repeat buyers alike. But they have special requirements to qualify.

USDA loans (0% down)

The U.S. Department of Agriculture offers a 100% financing mortgage. This program is known as the “Rural Housing Loan” or simply “USDA loan.”

The good news is that the USDA’s definition of rural is broader than you might think. These loans are available to buyers in many suburban neighborhoods as well as rural areas.

The USDA’s goal is to help “low-to-moderate income homebuyers” across most of the U.S., excluding major cities. About 97% of the country’s landmass is eligible under USDA’s definition.

USDA loan requirements:

- 0% down

- 640 credit score

- Debt-to-income ratio below 41%

- Two-year employment history

- Income below 115% of area median income

- Buy a single-family primary residence

- Buy in an eligible rural area

Another key benefit is that USDA mortgage rates are often lower than rates for comparable low- or no-down-payment mortgages. Financing a home via USDA can be the lowest-cost path to homeownership.

VA loans (0% down)

The VA loan is a zero-down mortgage available to members of the U.S. military, veterans, and surviving spouses.

VA loans are backed by the U.S. Department of Veterans Affairs. They offer lower rates and easier requirements to borrowers who meet VA mortgage guidelines.

Most veterans, active-duty service members, and honorably discharged service personnel are eligible for the VA program. Home buyers who have spent at least six years in the Reserves or National Guard are also eligible, as are spouses of service members killed in the line of duty.

VA loan requirements:

- Certificate of Eligibility from the VA

- 0% down

- 580-620 credit score

- Debt-to-income ratio below 41%

- Two-year employment history

- Buy a 1- to 4-unit primary residence

VA loans have no maximum loan amount. It’s often possible to get a VA loan above current conforming loan limits, as long as you have strong enough credit and you can afford the payments.

In addition, VA loans charge no ongoing private mortgage insurance (PMI). There’s only a one-time funding fee that can be rolled into your loan. That’s a serious benefit. It could lower your monthly payments by a few hundred dollars in some cases.

Finally, VA mortgage rates tend to be the lowest of any home loan program. This is usually the cheapest mortgage option for eligible veterans and service members.

Low down payment first-time home buyer loans

Not everyone will qualify for a zero-down mortgage. But it may still be possible to buy a house without paying money down if you choose a low-down-payment mortgage and use a government grant or loan to cover your upfront costs.

If you want to go this route, here are a few of the best low-money-down mortgages to consider.

Conventional loans (3% down)

A conventional loan is what most home buyers think of as a “standard” mortgage. These home loans are not backed by the government (unlike FHA, VA, or USDA loans). But they still have flexible guidelines that can help first-time buyers qualify more easily.

Some home buyers believe you need 20% down on a conventional loan. In reality, though, conventional programs start at just 3% down

Conventional loans that require only 3% down include:

The HomeReady and HomePossible programs can be especially helpful for first-time home buyers who earn low incomes. They offer easier qualification guidelines, including higher DTI limits and flexible income sources. Plus, these loans charge lower private mortgage insurance (PMI) rates than other conventional mortgages.

While requirements vary a little by lender and loan program, conventional loans all follow the same basic guidelines set by Fannie Mae and Freddie Mac:

Conventional loan requirements:

- 3% down

- 620 credit score

- Debt-to-income ratio below 43% (in most cases)

- Two-year employment history

- Loan amount within conforming loan limits

- Buy a 1- to 4-unit property

A conventional loan is often the best choice if you have a low down payment but a good FICO score, because strong credit will earn you a lower interest rate. And, unlike the FHA program, you can usually cancel PMI premiums after a few years — potentially shaving hundreds off your monthly mortgage payment.

FHA loans (3.5% down)

The FHA loan is a great option for first-time home buyers with lower credit scores. This program is backed by the Federal Housing Administration, and it’s famous for its more relaxed approach to credit scores and down payments.

With an FHA loan, you can put just 3.5% down as long as your credit score is 580 or higher. By contrast, a conventional mortgage requires only 3% down but you need a FICO score of at least 620 to qualify.

Some buyers who qualify for conventional financing can get a better rate with an FHA loan because FHA doesn’t adjust rates up for buyers with lower credit scores.

According to the FHA’s guidelines, you could even get a mortgage with a credit score of 500 to 579, as long as you can put at least 10% down. But in practice, it’s harder to find lenders who will allow FICOs below 580.

FHA loan requirements:

- 3.5% down

- 580 credit score

- Debt-to-income ratio below 45% (in most cases)

- Two-year employment history

- Buy a 1- to 4-unit primary residence

- Loan amount within local FHA loan limits

The major downside to an FHA loan is that you have to pay upfront and monthly mortgage insurance premiums (MIP). These are more expensive compared to conventional and USDA mortgage insurance.

But if an FHA loan will put you in a home when others won’t, the MIP cost is often worth it. And keep in mind that you can refinance to a cheaper loan later on when your credit improves.

How to get a down payment for a house

Most home buyers have to put at least some money down. But the good news is, the money doesn’t have to come out of your pocket. There are multiple ways to source your down payment.

If you’re having trouble saving up for a house, one of these strategies could help you make the minimum down payment needed for a home loan.

Six ways to fund a down payment:

- Use your savings

- Cash out investments

- Get a cash gift from a family member

- Apply for a down payment grant

- Borrow from your 401(k)

- Buy with a partner or friend

Mortgage lenders are usually happy to accept any of these for a down payment. But, depending on how you pay, there are special rules you may need to be aware of.

For example, home buyers using gift money for their down payment need to show get a gift letter from the donor. And the lender will want to see a clear paper trail showing where the funds came from and when they were deposited in your account.

If you’re planning to source a down payment from outside your savings — or if you’re wondering about possible alternatives — talk to your loan officer. They’ll be able to explain your options and fill you in on any additional requirements for the loan process.

Down payment assistance

Many first-time home buyers are eligible for cash assistance offered by state and local governments. These down payment assistance (DPA) programs can help you buy a house if you can’t afford the down payment out of pocket.

Some home buyer assistance programs offer up to 5% or more of the home’s sale price as a grant or loan. Many loans are silent second mortgage loans — loans that never have to be repaid if you stay in the home long enough.

If you’re using a low-down-payment FHA or conventional mortgage, DPA could potentially cover your entire down payment — leaving you with $0 out of pocket.

Keep in mind, you still have to pay upfront closing costs (more info on this below).

DPA programs nationwide

There are more than 2,000 DPA programs nationwide, with assistance available in every state. Each program has its own guidelines, though most require you to be a first-time home buyer with a low-to-moderate income.

The amount of money you could get varies by program, too. For instance, one down payment assistance loan in New York City can offer up to $100,000 for eligible buyers, while another in Arkansas tops out at $15,000.

If you’re hoping to qualify for a home-buying grant, the best first step is to contact either your local housing finance authority or a mortgage lender. Either one can tell you about local DPA options and help you find out whether you qualify.

Closing cost assistance

As we mentioned above, your down payment isn’t the only upfront cost when buying a home. Buyers are also responsible for closing costs.

These include loan origination fees charged by the lender along with third-party fees required to set up your home loan (things like the credit report, home appraisal, title search, and underwriting fees).

Usually, closing costs range from 3% to 5% of the loan amount. That’s $9,000 to $15,000 for a $300,000 loan.

Even if you qualify for a no-down-payment mortgage, you still need to get your closing costs covered if you want to buy a house with no money.

Fortunately, there are a variety of ways to get help with your closing costs.

Closing cost assistance

Most down payment assistance programs can be used for closing cost assistance, too. However, the grant or loan you receive likely won’t be enough to fully cover both the down payment and loan fees. So you may have to pay the remainder out of pocket.

Seller-paid closing costs

It’s possible for a motivated seller to pay your closing costs. The way this often works is that you pay a little more for the home, and the seller kicks back that “extra” cash to cover your fees. You’re essentially rolling the cost into your mortgage loan when you go this route.

Lender-paid closing costs

Some mortgage lenders offer incentives to home buyers; they might be willing to cover part or all of your closing costs. This can be helpful if you’re short on cash — but be aware that no-closing-cost mortgages usually come with higher interest rates. So you could pay significantly more over the life of the loan.

Can I buy a house with no money down and no closing costs?

It may be possible to buy a house with no money down and no closing costs if you qualify for a zero-down loan and get the seller to cover your fees. (For this to work, the seller would need to be very motivated, meaning there’s little competition for the home.)

You could also ask the lender to pay your closing costs. However, lender-paid closing costs typically come with higher interest rates. So while you’ll save money upfront, you could end up paying a lot more over the life of the loan.

Alternatively, if you qualify for down payment assistance, the funds can often be used for closing costs as well. However, most down payment grants aren’t large enough to cover both the down payment and loan fees in full, so expect to pay at least part of your closing costs out of pocket.

Buy a house with no money FAQ

Can you buy a house with no money down?

There are two ways to buy a house with no money down. One is to get a zero-down USDA or VA mortgage. The other is to get a low-down-payment mortgage and cover your upfront cost using down payment assistance. FHA and conventional loans are available with just 3% or 3.5% down, and that entire amount is allowed to come from down payment assistance or a cash gift.

What is the minimum down payment for a mortgage?

Down payment requirements vary by mortgage program. VA and USDA loans allow zero down payment. Conventional loans start at just 3% down. And FHA loans require at least 3.5% down. You are free to contribute more than the minimum down payment amount if you want.

How much are closing costs?

On average, closing costs are about 3% to 5% of the mortgage loan amount. That means closing costs on a $300,000 mortgage loan could range from $9,000 to $15,000. The amount you’ll pay in closing fees depends on your home purchase price, down payment amount, mortgage lender, and location.

Does the buyer always pay closing costs?

Every home buyer has to pay closing costs, though there are ways you can reduce your out-of-pocket expense. Buyers can ask the seller to cover their closing costs or have the lender pay them in exchange for a higher mortgage rate. You can also use funds from a down payment assistance program toward your upfront loan fees.

Are there zero-down mortgage loans?

There are just two first-time home buyer loans with zero down. These are the VA loan (backed by the U.S. Department of Veterans Affairs) and the USDA loan (backed by the U.S. Department of Agriculture). Eligible borrowers can buy a house with no money down but will still have to pay for closing costs.

Can I get an FHA loan with no down payment?

The FHA loan always requires a down payment of at least 3.5%. However, the money doesn’t have to come from your own savings. FHA accepts multiple down payment sources, including gift money and grants or loans from a government program. If you’re short on cash, talk to an FHA lender about your down payment funding options.

What credit score do I need to buy a house with no money down?

You’ll usually need a credit score of at least 640 for the zero-down USDA loan program. VA loans with no money down usually require a minimum credit score of 580 to 620. Low-down-payment mortgages, including conforming loans and FHA loans, also require FICO scores of 580 to 620.

Can I buy a house with no money in my bank account?

It’s possible to buy a house with no down payment using select mortgage programs. However, you likely need cash in your bank account to pay for upfront closing costs. In addition, banks want to see that you can afford your future mortgage payments. So even if you’re eligible for no down payment, having a zeroed-out account balance would hurt your chances of qualifying for a mortgage.

How can I get money for a down payment?

If you don’t have enough saved for a down payment, lenders allow you to use funds from other sources. Home buyer assistance programs offered by state and local governments can help eligible first-time buyers. You can also fund your down payment using gift money from relatives, a loan from your 401(k), cashed-out investments, or equity from another property you own. Talk to your mortgage lender about options if you’re short on cash.

What are down payment assistance programs?

Down payment assistance programs are available to home buyers nationwide, and many first-time home buyers are eligible. DPA can come in the form of a home buyer grant or a loan that covers your down payment and/or closing costs. Offerings vary by state, so be sure to ask your mortgage lender which programs you may be eligible for.

Should I put 20% down?

Conventional wisdom tells you to put 20% down when buying real estate. But that advice is outdated. A large down payment is no longer required and, if putting that much down would drain your bank account, it’s typically not the best idea. Experts often recommend a smaller down payment if it will help you buy a home sooner and leave you with cash in the bank for emergencies and new home expenses (like furniture and repairs).

Check your home buying options

Today’s home buyers have access to a wide range of mortgage programs. With all the low- and no-down-payment loans available, many first-time buyers can get into a house with little or even no money down.

If you’re ready to buy a house but don’t have a lot of cash saved up, ask your mortgage lender about options. Odds are, there’s a home loan that could work for your financial situation

The information contained on The Mortgage Reports website is for informational purposes only and is not an advertisement for products offered by Full Beaker. The views and opinions expressed herein are those of the author and do not reflect the policy or position of Full Beaker, its officers, parent, or affiliates.

By refinancing an existing loan, the total finance charges incurred may be higher over the life of the loan.

Source: themortgagereports ~ By: By: Maggie Overholt ~ Image: Canva Pro