After reaching a peak of 7.04% in January 2025, mortgage rates retreated to the mid-6% range in March but then reversed course and have remained stuck between 6.75% and 6.9% since early May.

The average 30-year fixed mortgage rate was 6.85% the first week of June, declining by only 8 basis points to 6.77% by the end of the month, according to Freddie Mac data. One basis point is one one-hundredth of a percentage point.

Mortgage rates could stay elevated—or even rise—if President Donald Trump’s tariff policies end up fueling inflation. Indeed, the Federal Reserve continues to delay cutting its key interest rate as it monitors inflation data. Consequently, many housing market analysts foresee mortgage rates only gradually easing by the end of 2025, if at all.

Fed Pauses Rate Cuts Again Amid Escalating Geopolitical Tensions, Tariff Turbulence

In a widely anticipated move, the Federal Open Market Committee (FOMC)—the Federal Reserve panel charged with setting interest rates—voted unanimously to keep the federal funds rate unchanged at its June two-day meeting. The federal funds rate is the overnight borrowing rate for commercial banks and credit unions and indirectly influences mortgage rates.

After holding rates between 5.25% and 5.5% between July 2023 and August 2024, the Fed implemented three rate cuts between September and December 2024, totaling one percentage point.

The June pause maintains the 4.25% to 4.5% target range and marks the fourth meeting in which policymakers voted to hold the rate steady.

The Fed also released its latest economic projections, forecasting an uptick in inflation and unemployment through 2027 compared to March projections. However, 2025’s interest rate path remained consistent, suggesting two cuts are still on the horizon, resulting in a 3.75% to 4% rate range by the end of the year.

In recent testimony before the House Financial Services Committee, Fed Chair Jerome Powell defended the central bank’s cautious stance, stating the need to learn more about the impact of tariffs on consumers before making any rate adjustments.

What This Means for Mortgage Rates and Home Affordability

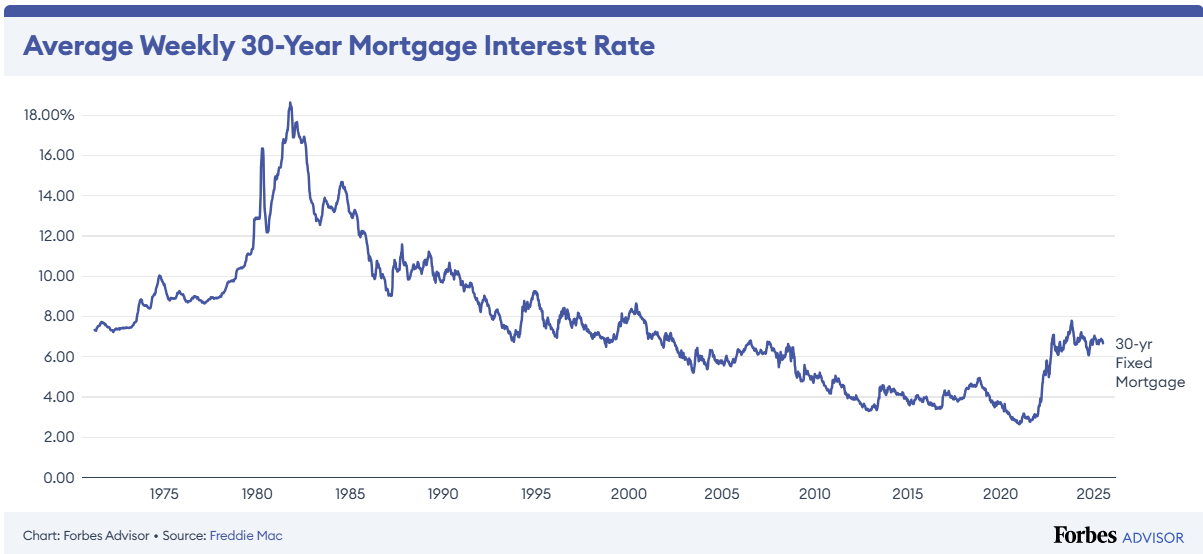

As the Fed began raising rates in March 2022 to wrestle runaway inflation down to its 2% target, the housing market felt the squeeze. Mortgage rates surged to decades-high levels as home prices hit historic peaks amid fierce demand and scant inventory, shutting the door on many would-be buyers.

Meanwhile, mortgage rates have stayed below 7% since January, but not by much.

“With little new out of the meeting, mortgage rates are likely to continue to hover in the high-6% range that has dominated for the last 8-plus months,” said Danielle Hale, chief economist at Realtor.com, in a written statement.

On the other hand, some experts say mortgage rates could get into a downward groove if inflation slightly cools and job growth persists over the summer, which would spur a rate cut at the Fed’s September meeting.

“[M]ortgage rates could fall even before the rate cut in response to these indicators,” said Lisa Sturtevant, chief economist at BrightMLS, in an emailed statement. “A decline in mortgage rates later this summer could give a jolt to the housing market, bringing buyers off the sidelines to take advantage of the dip in rates and expanded inventory.”

Should Buyers Wait for Rates To Fall?

Some experts caution that waiting for mortgage rates to drop further can be a risky strategy.

“For aspiring home buyers, the right time to buy really depends on your individual goals and financial situation,” says Fred Bolstad, head of retail home lending at U.S. Bank. “If you are in the financial position to afford the payments on a home you find and love, there is no need to wait.”

What’s Next?

The next two-day FOMC meeting is set for July 29 to 30. Could the Fed cut rates then?

While some policymakers expressed an openness to cut the federal funds rate in July, economists foresee a July cut as unlikely, since they expect to see the initial impacts of Trump’s tariffs on prices.

Following the June meeting, odds for another rate pause at the July meeting were roughly 4-to-1, while the expectation for the Fed to resume interest rate cuts in September was greater than 4-to-1, according to the CME FedWatch tool, a gauge that predicts Fed policy rate decisions.

Mortgage Rate Predictions for 2025

Here’s how some experts predict market conditions will affect the average 30-year fixed-rate mortgage in the third quarter of 2025 and beyond.

National Association of Home Builders (NAHB): 30-year fixed rate will average in the mid-6% range by the end of 2025

In his report highlighting key data from the April Macro Economic Outlook, Eric Lynch, economist at NAHB, offered this updated prediction: “As of April 10, the current Freddie Mac 30-year fixed-rate mortgage sits at 6.62%. While it will not be smooth, NAHB anticipates the 30-year mortgage rate to average around this rate by the end of 2025, and just above 6% by the end of 2026.”

NAR: Rates will average 6.4% in the second half of 2025 and 6.1% in 2026

“So mortgage rates can go down with a Fed rate cut if inflation is under control,” said Lawrence Yun, chief economist at NAR. “But it’s not going to go down to 4% mortgage rate conditions because we have a huge national debt… It cannot go to 4%, and it cannot go to 5%, but it can go to 6% with the Federal Reserve rate cuts and calmer inflation.”

Zillow Home Loans: Mortgage rates are on a bumpy path

“The future path of mortgage rates is uncertain, dependent on both economic data and headlines from the new administration’s policies,” writes Kara Ng, senior economist at Zillow, in the April Forecast. “While Zillow expects mortgage rates to end the year near mid-6%, barring any unforeseen shocks, that path might be bumpy.”

Fannie Mae: Revises mortgage rate forecast upward

Per Fannie Mae’s June Economic and Housing Outlook: “We forecast mortgage rates to end 2025 and 2026 at 6.5 percent and 6.1 percent, respectively, up from 6.1 and 5.8 percent in our prior forecast.”

Freddie Mac: Expect rates to remain high in 2025

According to its January Economic, Housing and Mortgage Market Outlook, Freddie Mac expects mortgage rates to stay “higher for longer” this year, with the slightly lower rates (compared to 2024) leading to a boost in refinance volume.

Mortgage Bankers Association (MBA): Rates will average 6.8% in the third quarter and recede slightly by the end of the year

According to the MBA’s June Mortgage Finance Forecast, the real estate finance association revised its average quarterly mortgage rate projections upward from last month. The trade association now predicts the 30-year fixed-rate mortgage to average 6.8% in the third quarter of 2025 (up from 6.7%) and end the year at 6.7% (up from 6.6%). The MBA expects an average rate of 6.6% in the first quarter of 2026 (up from 6.5%.)

BOK Financial: Expecting rates to stay high in the coming months

“Based on recent inflation concerns across the economy, the Federal Reserve does not sound interested in rate cuts anytime soon,” says Michael Merritt, senior vice president of customer care and default mortgage servicing at BOK Financial and Forbes Advisor advisory board member. “As such, I expect rates to stay in the [high-6% to low-7%] range over the next few months—a similar range they have moved over the last month.”

Jome: Mortgage rate movement will depend on Fed, economy

“When it comes to mortgage rates and inflation, beyond the usual impact of monetary policy and natural inflation trends, we may see additional inflationary pressure from potential tariffs on major trading partners,” said Dan Hnatkovskyy, economist, housing market expert and CEO of Jome, a real estate company specializing in new construction home transactions. “This type of inflation could likely cause the Fed to pause rate cuts. … [B]ased on current trends and historical patterns, it seems unlikely that we’ll see significant declines in Fed rates or mortgage rates this year, given the added inflationary pressures.”

First American Financial Corporation: Elevated rates are staying put for a while

“A ‘higher-for-longer’ mortgage rate environment will continue to dampen house-buying power,” says Mark Fleming, chief economist at First American.

Bright MLS: Mortgage rates should decline late summer

“I expect mortgage rates to decline more significantly at the end of the summer, leading up to the Fed’s September meeting,” predicts Lisa Sturtevant, chief economist at BrightMLS, in recent commentary. “Lower rates could bring more buyers out this fall. But it is becoming more of a possibility that weakening consumer confidence and labor market concerns may cast a long shadow into the fall housing market.”

J.P. Morgan: Mortgage rates will remain above 6.5% in 2025

According to financial services firm J.P. Morgan’s February outlook for the U.S. housing market in 2025, “The higher-for-longer interest rate backdrop is here to stay, with mortgage rates expected to ease only slightly to 6.7% by the year end.”

Wells Fargo: Federal Funds Rate Cuts May Offer Modest Mortgage Rate Relief

“While reductions in the federal funds rate should allow for additional mortgage rate relief later this year, we currently do not anticipate mortgage rates to recede below 6.5%,” according to Wells Fargo in a recent report.

TransUnion: Trade policy will keep mortgage rates elevated

“Due to the anticipated impacts of announced tariffs on near-term inflation, mortgage rates are expected to remain elevated above 6% in the next quarter,” says Satyan Merchant, senior vice president, automotive and mortgage business leader at TransUnion.

Current Mortgage Rate Trends

Many industry experts forecasted last year that rates would be closer to 6% by the end of 2024 and drift below this threshold by the first or second quarter of 2025.

Meanwhile, here we are in the third quarter, and mortgage rates remain well above those forecasts, with an average 30-year fixed mortgage rate of 6% nowhere in sight.

Here’s how rates have trended over the past five years for 15- and 30-year mortgages.

When Will Be the Best Time To Refinance in 2025?

To evaluate whether or not a refinance would be realistic, you want to evaluate your reasoning. If the goal is debt consolidation, it could make sense, but if you’re trying to reduce the payment, it could be more challenging to achieve in the current higher-rate environment. The only way to know for sure is to speak with a mortgage lender to explore your options.

— Jenn Bourque, loan officer at Empire Home Loans and Forbes Advisor advisory board member

Whether 2025 emerges as an ideal year to refinance depends on several factors, including the number of times the Fed cuts interest rates and by how much. The mortgage rate you got when you initially financed your home is another major factor.

Refinance rates tend to be higher than purchase rates, but the two typically move in tandem, suggesting refinance activity could gain greater traction if rates continue their downward trend.

Should You Refinance If You Already Have a Good Rate?

Over 40% of U.S. mortgages were originated in 2020 and 2021, when interest rates were at record lows. There were also some 14 million mortgage refinances during the same time.

If you were lucky enough to secure a mortgage during that period, 2025 may not be the ideal time to refinance, considering mortgage rates could stay well above 6% in the coming months.

“Most homeowners refinance to reduce their monthly mortgage payments with a lower interest rate,” wrote Archana Pradhan, an economist at CoreLogic, in a recent report. Pradhan adds that only about 12% of mortgage loans have a rate of 6% or more, many of which were originated in 2023 and 2024.

Recent Refinance Trends

Refinance activity in June posted mixed results week over week, but activity remained strong compared to the same period a year ago. June mortgage rates were slightly lower than the same time last year.

Even so, mortgage rates have remained well above 6.5% for most of 2025. Another postponed Fed rate cut could indirectly maintain upward pressure on mortgage rates, impacting refinance demand.

Here are recent trends in refinance activity, according to the MBA’s Weekly Mortgage Applications Survey.

| 2025 REFINANCE ACTIVITY | WEEKLY | ANNUALLY |

|---|---|---|

|

Week ending May 30

|

-4%

|

+42%

|

|

Week ending June 6

|

+16%

|

+28%

|

|

Week ending June 13

|

-2%

|

+25%

|

|

Week ending June 20

|

+3%

|

+29%

|

How To Shop for the Best Mortgage Rate

Rather than waiting it out for a rate that they like better, hopeful homebuyers should assess their personal financial situation—if the house is right for them, and the upfront and monthly payments are affordable, it could be the right chance to make a move.

– Matt Vernon, head of retail lending, Bank of America

Getting an optimal rate on a home loan can save you a significant amount of money over time. Here are some tips that can help you get the best rate possible for your situation:

- Keep your eye on rates. Mortgage rates are constantly changing. Keeping a close watch will make it easier to find and lock in a better rate.

- Check your credit. When you apply for a mortgage, the lender will review your credit to determine your creditworthiness as well as your interest rate. In general, the higher your credit score, the better your rate will be. To get an idea of where you stand, check your credit before you apply and dispute any errors with the appropriate credit bureau to potentially boost your score.

- Shop around and compare lenders. Consider options from as many mortgage lenders as possible to find the best deal for you. Prospective buyers have saved more than $1,500 over a loan’s term by getting two quotes from lenders and saved roughly $3,000 when they sought five quotes, according to Freddie Mac.

Source: Forbes.com ~ By: Robin Rothstein ~ Image: Forbes.com