Mortgage rate forecast for next week (May 30-June 3)

After growing in the wake of the Federal Reserve’s May meeting, mortgage rates took a step back.

The average 30-year fixed interest rate dropped from 5.30% on May 12 to 5.25% on May 19.

With the Fed planning hikes after each of its remaining 2022 meetings, most indicators point toward interest rates growing further in 2022. However, economic uncertainty will cause week-to-week volatility.

Key Takeaways

- Will rates go down in June?

- 90-day forecast

- Expert rate predictions

- Mortgage rate trends

- Rates by loan type

- Mortgage strategies for June

- Mortgage rates FAQ

Will mortgage rates go down in June?

Mortgage rates surged through the first quarter of 2022. The 156 basis point (1.56%) gain represented the fastest three-month rise since May 1994, according to Freddie Mac.

With the pandemic’s declining economic impact, inflation running at 40-year highs, and the Federal Reserve outlining an aggressive policy plan, interest rates could continue trending upward.

Experts from the Mortgage Bankers Association, the National Association of Realtors and other industry leaders are split on whether 30-year mortgage rates will keep climbing in June or level off.

With the Fed announcing more rate-hike plans, mortgage markets have likely already priced in much of the impact. However, interest rates could grow further if inflation remains out of control while a spike in positive Covid cases or the war in Ukraine could cause some weekly decreases.

“With much uncertainty in the economic outlook, mortgage rates are likely to continue to creep up over the next month, particularly as Fed’s rhetoric around reestablishing price stability continues.”

—Selma Hepp, deputy chief economist at CoreLogic

Nadia Evangelou, senior economist and director of forecasting at the National Association of Realtors

Prediction: Rates will rise

“Unyielding inflation and Federal Reserve’s tightening policy are the main factors that drive up today’s mortgage rates. Meanwhile, data indicates that inflation will remain elevated for the next several months. Thus, the Federal Reserve will need to make multiple rate hikes in order to drop inflation to its 2% target.

There will likely be five more rate hikes this year. Apart from that, the Federal Reserve will start reducing the size of its balance sheet in June. This means that the Fed will lower its bond holdings increasing the supply of the U.S. Treasuries on the market. This strategy is expected to move up further Treasury yields and mortgage rates in the second half of 2022. Thus, I expect the rate on a 30-year fixed mortgage to average 5.5% by mid-2022.”

Selma Hepp, deputy chief economist at CoreLogic

Prediction: Rates will rise

“With much uncertainty in the economic outlook, mortgage rates are likely to continue to creep up over the next month, particularly as Fed’s rhetoric around reestablishing price stability continues to drive expectations of temporary overshoot in the fund rate. Unfortunately, there are still many headwinds for inflation which will continue to keep the inflation rate elevated, not least of which is the growth in home prices and rents.

Also, balance sheet runoff is potentially not yet fully priced in, which will also keep financial markets open to further pricing it in. That said, mortgage rates could be inching lower by the end of the summer as lenders fully experience the damaging impact of higher rates on home buying demand.”

Joel Kan, associate vice president, industry surveys and forecasts at Mortgage Bankers Association

Prediction: Rates will moderate

“Even with some easing in Treasury yields over the past few days, our forecast is for mortgage rates to continue to hover above the 5% mark over the next few months. However, we expect ongoing volatility in rates as markets continue to digest the impact of the Federal Reserve’s tightening of monetary policy and as the Fed’s plans for reducing the size of its Treasury and MBS holdings are implemented.

Additionally, despite a still-strong job market, our growth expectations for the U.S. economy were revised lower, impacted by higher rates, higher prices, and weakening consumer sentiment. The uncertainty around this weakening will likely contribute to rates staying close to current levels as well.”

Odeta Kushi, deputy chief economist at First American

Prediction: Rates will moderate

“Mortgage rates may remain relatively steady in June, which would give buyers a brief reprieve from the rapid rise in rates over the last few months. The popular 30-year, fixed mortgage rate is loosely benchmarked to the 10-year Treasury note, and there are opposing forces at work in the bond market.

“And while the near-term prospect of further Fed tightening has already been baked into mortgage rates, the Fed is also expected to release their dot plot projections in the June meeting. If inflation expectations are higher than expected or the Fed has to take more drastic actions than anticipated to tame inflation, mortgage rates may move up further. However, if geopolitical or economic concerns worsen, the rush to safety in U.S. Treasury bonds may accelerate, which could push mortgage rates lower. Ultimately, it’s likely that mortgage rates will continue to drift higher in the months to come, unless the Fed can get inflation under control.”

Taylor Marr, deputy chief economist at Redfin

Prediction: Rates will moderate

“I estimate that interest rates are uncertain right now, even in the near term. Rates are just as likely to stay flat or fall as they are to continue climbing like they have. Therefore, my prediction is that 30-year fixed rates will only average 5.3% in June.

If inflation expectations fall and consumer expectations for slowing economic growth continue, these factors could counteract the pressure the mortgage market will feel from the Fed continuing to raise short-term interest rates and wind down their balance sheet. Additionally, the spread on the 30-year fixed over the 10-year treasury remains elevated at 2.3% relative to its historical average of 1.8%. This indicates that there is still a downward opportunity for relief in mortgage rates to mitigate the continued upward pressure from the Fed working to tame inflation.”

Rick Sharga, executive vice president at Attom Data Solutions

Prediction: Rates will rise

“After 10 consecutive weeks on increases which saw interest rates on 30-year fixed rate mortgages soar from 3.89% to 5.30%, they dipped slightly to 5.25% as of May 19th. Unfortunately, this is more likely a temporary respite than a reversal of course for interest rates.

Persistently high inflation, another round of rate increases by a Federal Reserve Bank which is taking an increasingly aggressive posture, and the continued unwinding of the Fed’s position in the securities market make it almost inevitable that mortgage rates will continue to move up in June.

These rate increases may be smaller and more gradual than the rapidly rising rates we’ve seen over the past few months. Yields on the 10-year U.S. Treasury have dipped back below 3% and the combination of higher rates and higher home prices appear to be slowing down the housing market, which could have implications for the broader economy. So it seems unlikely that rates will exceed 5.5% by the mid-year mark.”

Mortgage interest rates forecast next 90 days

Aside from uncertainty surrounding the Russian-Ukrainian conflict or a spike in positive Covid cases warranting new restrictions, other major indicators point toward further mortgage rate growth.

In all likelihood, average interest rates will increase over the next three months. Of course, mortgage rates tend to be volatile so we could see some drops mixed in as well.

Mortgage rate predictions for 2022

The average 30-year fixed-rate mortgage ended the first quarter of 2022 at 4.67%, according to Freddie Mac.

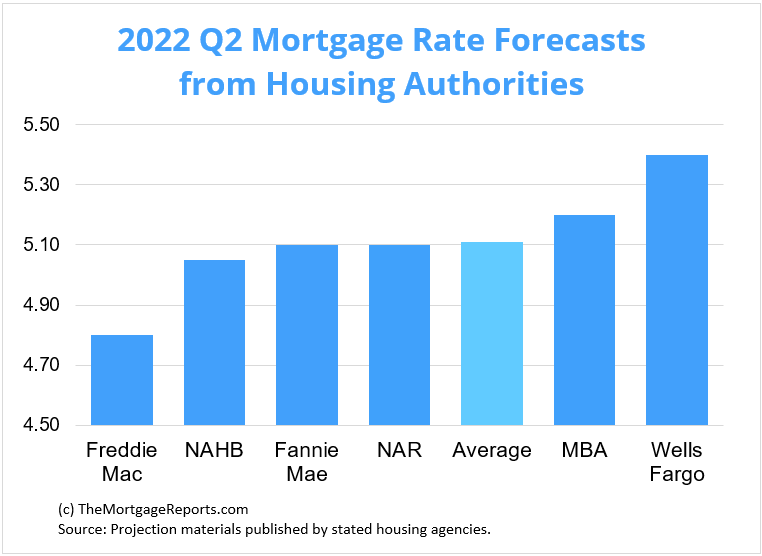

All six of the major housing authorities we gathered project that average to rise over the second quarter of 2022.

Freddie Mac and the National Association of Home Builders sit at the low end of the group, estimating the average 30-year fixed interest rate will settle at 4.8% or 5.05% by the end of Q2. The Mortgage Bankers Association and Wells Fargo had the highest predictions, with forecasts of 5.2% and 5.4%, respectively, by the end of June.

| Housing Authority | 30-Year Mortgage Rate Forecast (Q2 2022) |

| Freddie Mac | 4.80% |

| National Association of Home Builders | 5.05% |

| Fannie Mae | 5.10% |

| National Association of Realtors | 5.10% |

| Mortgage Bankers Association | 5.20% |

| Wells Fargo | 5.40% |

| Average Prediction | 5.11% |

Current mortgage interest rate trends

Current mortgage interest rate trends

Average mortgage rates fell on May 19 after rising in eight out of the ten past weeks.The average 30-year fixed rate decreased from 5.30% to 5.25% for the seven days ending May 19, according to Freddie Mac’s weekly rate survey.The 15-year fixed rate also declined from 4.48% to 4.43%, while the average rate for a 5/1 ARM rose from 3.98% to 4.08 percent.

| Month | Average 30-Year Fixed Rate |

| May 2021 | 2.96% |

| June 2021 | 2.98% |

| July 2021 | 2.87% |

| August 2021 | 2.84% |

| September 2021 | 2.90% |

| October 2021 | 3.07% |

| November 2021 | 3.07% |

| December 2021 | 3.10% |

| January 2022 | 3.45% |

| February 2022 | 3.76% |

| March 2022 | 4.17% |

| April 2022 | 4.98% |

Source: Freddie Mac

Mortgage rates moved on from the record–low territory seen in 2020 and 2021 but are still low from a historical perspective.

Dating back to April 1971, the fixed 30–year interest rate averaged 7.79%, according to Freddie Mac.

So if you haven’t locked a rate yet, don’t lose too much sleep over it. You can still get a great deal — especially if you’re a borrower with strong credit.

Just make sure you shop around to find the best lender and lowest rate for your unique situation.

Mortgage rate trends by loan type

Many mortgage shoppers don’t realize there are different types of rates in today’s mortgage market.

But this knowledge can help home buyers and refinancing households find the best value for their situation.

Following are 3–month mortgage rate trends for the most popular types of home loans: conventional, FHA, VA, and jumbo.

| April 2022 | March 2022 | February 2022 | |

| Conforming Loan Rates | 5.42% | 4.79% | 4.09% |

| FHA Loan Rates | 5.28% | 4.81% | 4.11% |

| VA Loan Rates | 5.08% | 4.57% | 3.77% |

| Jumbo Loan Rates | 4.89% | 4.37% | 3.76% |

Source: Black Knight Originations Market Monitor Report

Which mortgage loan is best?

The best mortgage for you depends on your financial situation and your goals.

For instance, if you want to buy a high–priced home and you have great credit, a jumbo loan is your best bet. Jumbo mortgages allow loan amounts above conforming loan limits, which max out at $647,200 in most parts of the U.S.

On the other hand, if you’re a veteran or service member, a VA loan is almost always the right choice.

VA loans are backed by the U.S. Department of Veterans Affairs. They provide ultra-low rates and never charge private mortgage insurance (PMI). But you need an eligible service history to qualify.

Conforming loans and FHA loans (those backed by the Federal Housing Administration) are great low–down–payment options.

Conforming loans allow as little as 3% down with FICO scores starting at 620.

FHA loans are even more lenient about credit; home buyers can often qualify with a score of 580 or higher, and a less–than–perfect credit history might not disqualify you.

Finally, consider a USDA loan if you want to buy or refinance real estate in a rural area. USDA loans have below-market rates — similar to VA — and reduced mortgage insurance costs. The catch? You need to live in a ‘rural’ area and have moderate or low income to be USDA–eligible.

Mortgage rate strategies for June 2022

Mortgage rates grew rapidly and significantly to open 2022. While the pace may slow, they’re expected to keep climbing in June and through the rest of the year. But opportunities to lock in a low interest rate do still exist for home buyers and refinancing homeowners.

Here are just a few strategies to keep in mind if you’re mortgage shopping in the next few months.

Move quickly and be prepared

In May, the Federal Reserve made its largest federal funds rate hike in 22 years and has a hike planned for each of the five remaining FOMC meetings this year. The central bank’s actions are a means to offset 2022’s historically high inflation.

These actions indirectly yet intrinsically impact mortgage rates and they’ve grown following each meeting so far this year. The average 30-year fixed rate jumped 31 basis points (0.31%) and 17 basis points (0.17%) immediately after the FOMC meetings in March and May, respectively. The next meeting is set for June 14-15.

Of course, mortgage rates typically exhibit week-to-week volatility but most indicators signal further growth over the remainder of 2022. In order to take advantage of when a weekly dip occurs, you’ll need all your paperwork ready for your lender so you can get a streamlined approval.

Advocate for a lower rate

This will take a little work but the end result will be well worth it (and save you money) if you end up with a lower interest rate than originally offered.

While the growing rate environment decreases affordability and reduces potential buyers from the market, this reduction can be used to your advantage. Loan volume is declining around the industry with refinancing and purchases falling as rates rise. This means lenders will be more open to competing for your business and potentially could offer you a rate below the average.

Once you get qualified (or prequalified) rates from a handful of lenders, shop them around and see how low they will go.

How to shop for interest rates

Rate shopping doesn’t just mean looking at the lowest rates advertised online because those aren’t available to everyone. Typically, those are offered to borrowers with perfect credit and who can put a down payment of 20% or more.

The rate lenders actually offer depends on:

- Your credit score and credit history

- Your personal finances

- Your down payment (if buying a home)

- Your home equity (if refinancing)

- Your loan-to-value ratio (LTV)

- Your debt-to-income ratio (DTI)

To figure out what rate a lender can offer you based on those factors, you have to fill out a loan application. Lenders will check your credit and verify your income and debts, then give you a ‘real’ rate quote based on your financial situation.

You should get three to five of these quotes at a minimum. Then compare them to find the best offer.

Look for the lowest rate, but also pay attention to your annual percentage rate (APR), estimated closing costs, and ‘discount points’ — extra fees charged upfront to lower your rate.

This might sound like a lot of work. But you can shop for mortgage rates in under a day if you put your mind to it. And shaving just a few basis points off your rate can save you thousands.

Mortgage interest rate FAQ

Current mortgage rates are averaging 5.25 percent for a 30-year fixed-rate loan, 4.43 percent for a 15-year fixed-rate loan, and 4.08 percent for a 5/1 adjustable-rate mortgage, according to Freddie Mac’s latest weekly rate survey. Your individual rate could be higher or lower than the average depending on your credit score, down payment, and the lender you choose to work with, among other factors.

Mortgage rates could decrease next week (May 30-June 3, 2022) depending on if the market overcorrected for the latest hike from the Federal Reserve. However, rates could rise if the high inflation of 2022 continues and needs to be reigned in.

It’s unlikely mortgage rates will go down in 2022. Inflation has been climbing at a record rate over the last few months. And the Fed is planning to raise interest rates after each of its scheduled FOMC meetings. Both these factors should lead to significantly higher mortgage rates in 2022.

Yes, it’s very likely mortgage rates will increase in 2022. High inflation, a strong housing market, and policy changes by the Federal Reserve should all push rates higher in 2022. The only thing likely to push rates down would be a major resurgence in serious Covid cases and further economic shutdowns. But, while it could help mortgage rates, no one is hoping for that outcome.

Freddie Mac is now citing average 30-year rates in the 5 percent range. If you can find a rate in the 4s, you’re in a very good position. Remember that rates vary a lot by borrower. Those with perfect credit and large down payments may get below-average interest rates, while poor-credit borrowers and those with non-QM loans could see much higher rates. You’ll need to get pre-approved for a mortgage to know your exact rate.

For the most part, industry experts do not expect the housing market to crash in 2022. Yes, home prices are over-inflated. But many of the risk factors that led to the 2008 crash are not present in today’s market. Low inventory and massive buyer demand should keep the market propped up next year. Plus, mortgage lending practices are much safer than they used to be. That means there’s not a subprime mortgage crisis waiting in the wings.

At the time of this writing, the lowest 30-year mortgage rate ever was 2.65 percent. That’s according to Freddie Mac’s Primary Mortgage Market Survey, the most widely used benchmark for current mortgage interest rates.

Locking your rate is a personal decision. You should do what’s right for your situation rather than trying to time the market. If you’re buying a home, the right time to lock a rate is after you’ve secured a purchase agreement and shopped for your best mortgage deal. If you’re refinancing, you should make sure you compare offers from at least three to five lenders before locking a rate. That said, rates are rising. So the sooner you can lock in today’s market, the better.

That depends on your situation. It’s a good time to refinance if your current mortgage rate is above market rates and you could lower your monthly mortgage payment. It might also be good to refinance if you can switch from an adjustable-rate mortgage to a low fixed-rate mortgage; refinance to get rid of FHA mortgage insurance; or switch to a short-term 10- or 15-year mortgage to pay off your loan early.

It’s often worth refinancing for 1 percentage point, as this can yield significant savings on your mortgage payments and total interest payments. Just make sure your refinance savings justify your closing costs. You can use a mortgage calculator or speak with a loan officer to crunch the numbers.

Start by choosing a list of three to five mortgage lenders that you’re interested in. Look for lenders with low advertised rates, great customer service scores, and recommendations from friends, family, or a real estate agent. Then get pre-approved by those lenders to see what rates and fees they can offer you. Compare your offers (Loan Estimates) to find the best overall deal for the loan type you want.

What are today’s mortgage rates?

Mortgage rates are rising, but borrowers can usually find a better deal by shopping around. Connect with a mortgage lender to find out exactly what rate you qualify for.

Source: themortgagereports.com ~ Image: