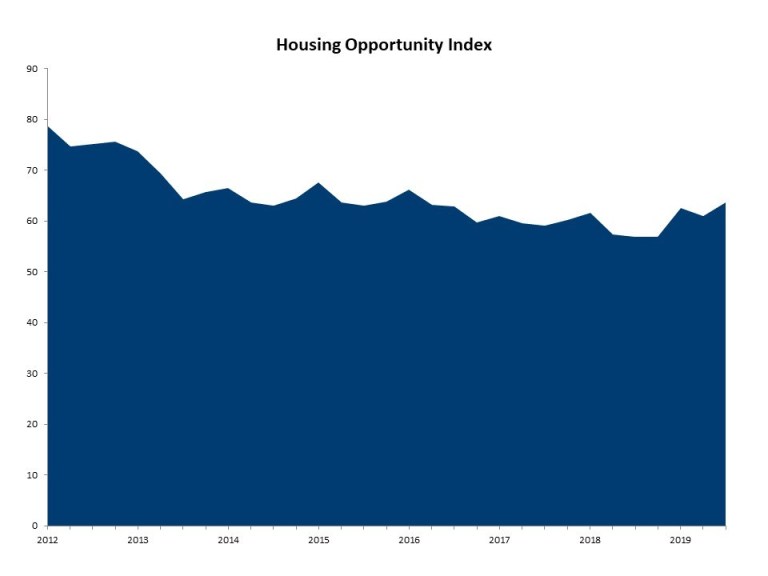

One year after hitting a ten-year low, housing affordability has risen to its highest level in three years. Rose Quint, writing in the National Association of Home Builders Eye on Housing Blog, says 63.6 percent of new and existing homes sold in the third quarter of this year were affordable to households earning the U.S. median income of $75,500.

It was exactly one year ago when Quint wrote that only 56.4 percent homes sold during Q3 of 2018 were affordable to families who were earning the then current median income of $71,000. At that point the prevailing interest rate was 4.72 percent and the median home price was $268,000. The NAHB/Wells Fargo Housing Opportunity Index (HOI) had risen to reflect 60.9 percent affordability by the second quarter of this year.

The improved affordability is almost entirely due to a three-year low in interest rates as home prices have increased. The median sales price in Q3 was flat compared to the second quarter at $280,000, but significantly higher than in the first quarter ($260,000) as well as a year earlier. At the same time, average mortgage rates fell from 4.07 percent in the second quarter to 3.73 percent in the third quarter.

Scranton-Wilkes-Barre was the nation’s most affordable major housing market. Almost 90 percent of all new and existing homes sold in the third quarter were affordable to families earning the area’s median income of $67,000. The most affordable smaller market was Monroe, Michigan where 95.3 percent were affordable to families earning the median income of $79,000.

San Francisco again ranked as the nation’s least affordable major market. Only 8.4 percent of the homes sold in the third quarter of 2019 were affordable to families earning the area’s median income of $133,800. All five least affordable small housing markets were also in the Golden State. At the very bottom of the affordability chart was Salinas, where families earning $74,100 could afford only 13.4 percent of the homes sold there in Q3.

Quint says that, although lower mortgage rates have offset some of the increases in construction costs and improved affordability, builders’ ability to increase inventory remains severely constrained by a chronic labor shortage and excessive regulations.

Source: mortgagenewsdaily.com ~ Image: mortgagenewsdaily.com